4

JanRefunds are actual funds, money that go back to the customer. There are two modes of refund:

External, as in manual, e.g. a refund check

Electronic, issued through a payment gateway

We can do refunds:

on Payments that have an unallocated balance or

on Credit Note Lines with an unallocated balance.

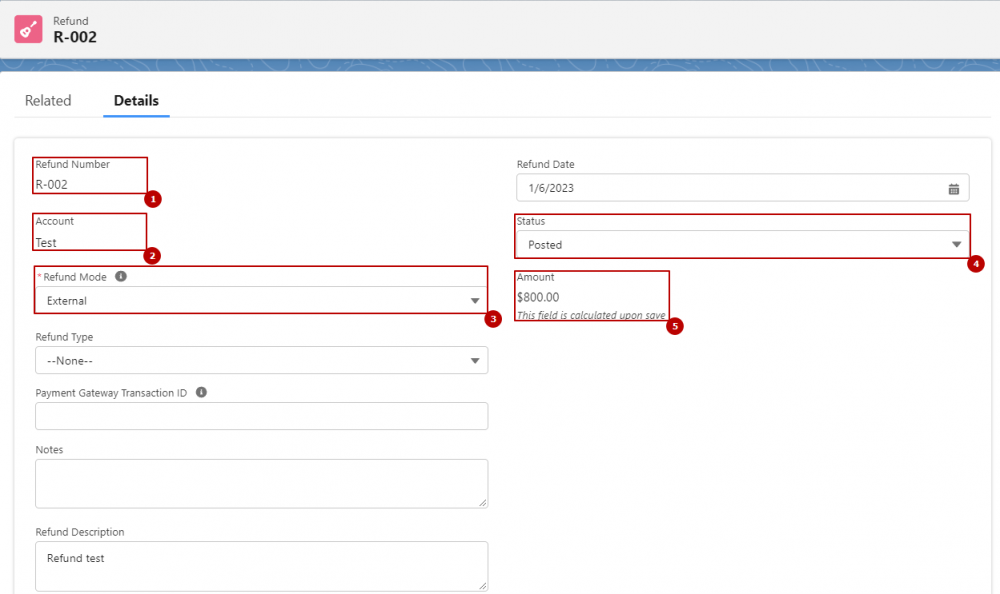

The Refund record is directly associated with an account (there is a lookup to it). On the Refund record, you can also see the Status field which can be Draft, Posted, Cancelled, and the Amount formula field which is calculated upon save (blng__RefundedfromPayments__c + blng__RefundedfromCreditNoteLines__c)

The values in the Refunded from Payments and Refunded from Credit Note Lines are taken from the corresponding Refund Lines which store actual amounts. There are two types of Refund Lines depending on the record we are issuing the refund against:

Refund Line (Payment) with a lookup to the related Payment

Refund Line (Credit Note Line) with a lookup to the related Credit Note Line

So if you need to issue a refund against a payment while the customer has already paid a posted invoice, you must first and foremost, unallocate the payment balance. Unallocating a payment will allow you to return the balance from the invoice to the payment so that there is an outstanding balance on a payment.

The next step is essentially balancing out that invoice, for example by crediting the invoice (Credit button).

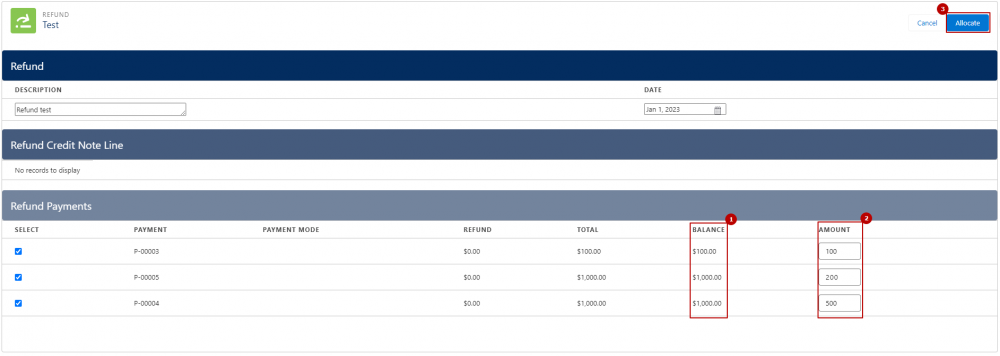

Then, click the Refund button on the Account record. Select the currency, mode of refund (external or electronic), select the payment, and enter an amount for the refund. Provide all necessary information and click Allocated.

This will create the Refund record and the Refund Lines records automatically.

The Refund button can also be accessed directly from the Payment record.

Comments (0)