18

JanThe billing process generates a substantial quantity of transactional records. There are invoices with invoice lines, payments with payment allocations, credit notes, and debit notes with the corresponding lines and allocations, and refunds and refund lines. During any billing period, a large number of records, potentially reaching up to tens of thousands, can be generated solely from sales.

Being able to keep all of that information organized and being able to report on it quickly and then also being able to integrate it downstream to the ERP system is very important. Of course, Salesforce Billing keeps track of different records that are generated through the billing process with the help of Finance Books and Finance Periods. Hence, we need to know what configuration is required to define the record-keeping functions. And the best part? You can do it all once with minimal maintenance over time.

But, before we dive into that, let's take a step back and understand what exactly finance books and finance periods are. Finance books organize and store finance periods while the finance period is essentially, a period of time. With the help of finance books, you can take a quick look at the finance period and see all the accounting and revenue recognition records that were generated during that period.

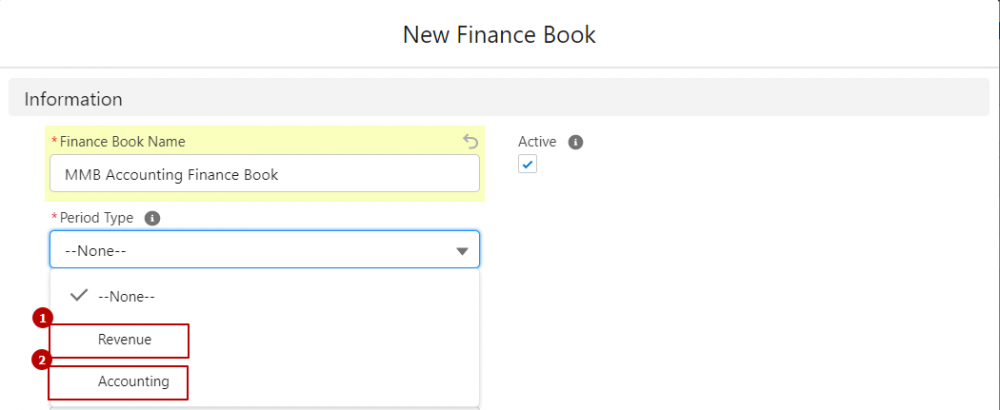

Now, there are two types of finance periods:

Accounting and

Revenue

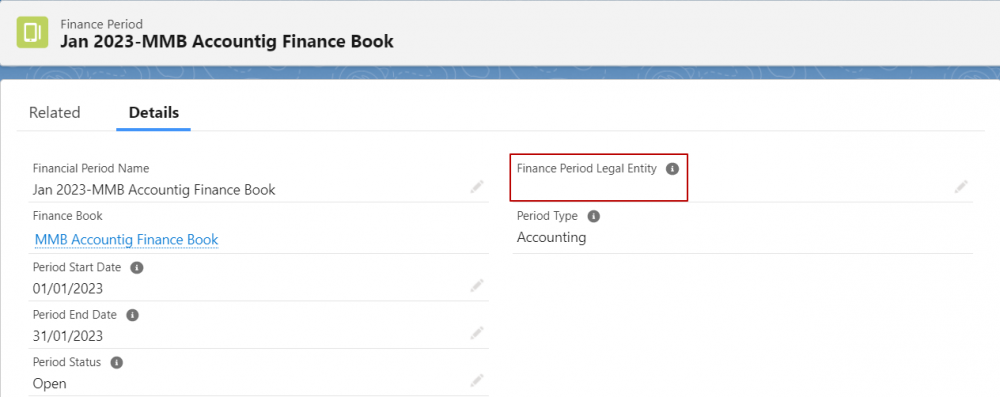

Accounting finance periods hold all the invoice lines, credit note allocation, debit note allocation, and payment allocations that fall within a specific date range. Whereas, revenue finance periods hold all the revenue transactions. The Period Type field on the finance book record determines what kind of records will be associated with the finance period.

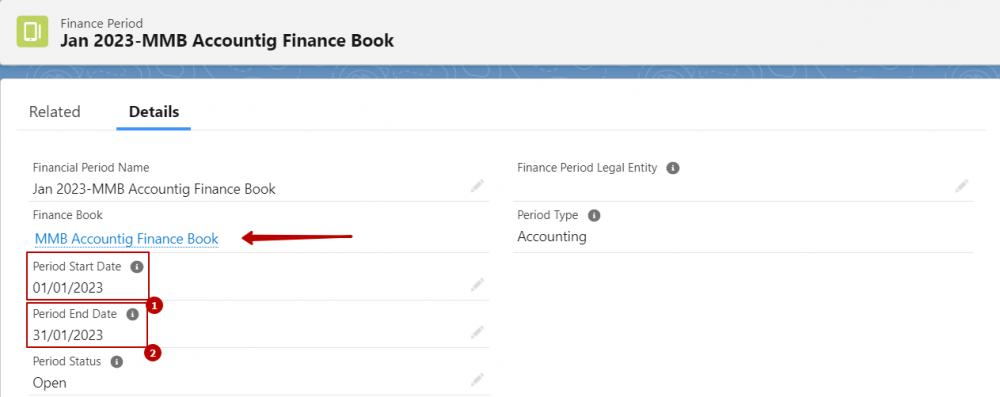

Obviously, finance periods have a look up to the finance book object.

The finance period Start Date and End Date define the date range in which related records will apply to that finance period.

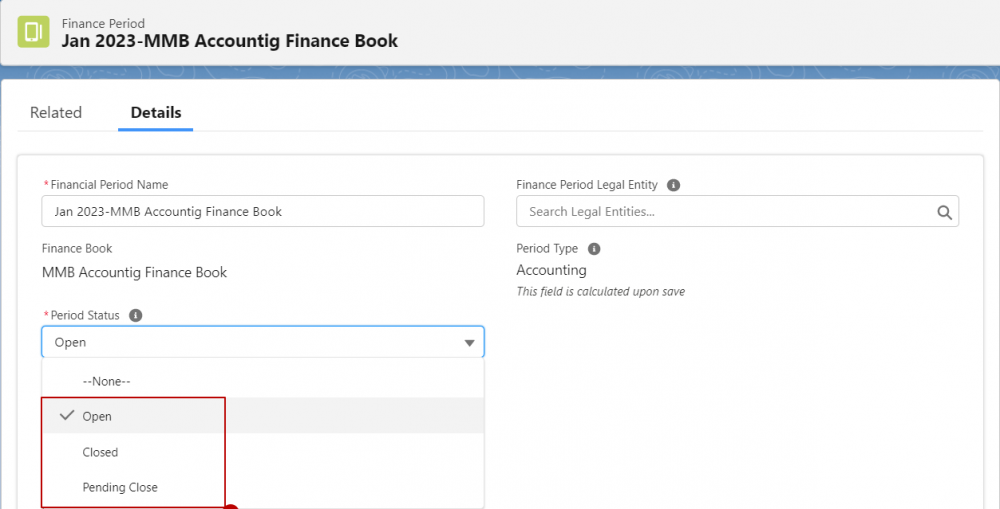

The period Status field determines if a record can be associated with that finance period:

“Open” status finance periods receive new records.

“Closed” finance periods don't receive new records. Have you ever heard accountants talking about closing their books at the end of the month or end of the year and about making sure you get your transactions in time? This is what they are talking about.

But, what if you have different regional business units? No problem. The finance periods also have a look up to the Legal Entity object, which supports the possibility for separate books to be kept for different regional business units. So, you can have a finance book for your US legal entity and a finance book for your UK legal entity.

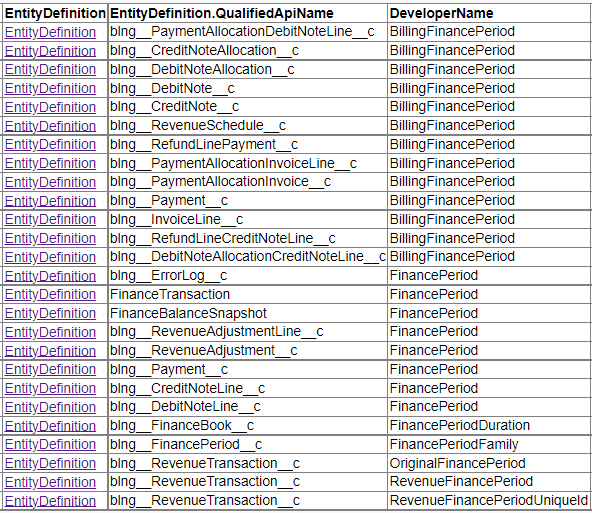

All the transactional records that we mentioned above (invoice lines, credit note allocations, debit note allocations, payment allocations, and revenue transaction records) have lookups to the finance period records. So, when they are generated, they will automatically be associated with the correct finance period.

Comments (0)